Finance, Leasing & Real Estate Business Division

Major Products and Areas

- Auto finance business

- Aircraft leasing business and aircraft engine leasing business

- Commercial vehicles fleet management business

- General leasing and non-bank business

- Next-generation finance business and femtech business

- Insurance business

- Private equity fund investment and management business, domestic investment business

- Domestic and overseas real estate development business and AM business

- Real estate REIT and fund management business

Our Strengths

Auto Finance Business

Our auto finance business offers industry-leading products, services, and technology solutions for B2B and B2C clients in various countries around the world, including the United States, Australia, and Indonesia. Our business continuously achieves year-over-year growth, driven by cutting edge data analysis technology and accumulated knowledge cultivated over many years in the automotive industry.

-

Auto Finance Business (U.S.A.) -

Auto Finance Business (Indonesia)

Aircraft Leasing Business and Aircraft Engine Leasing Business

Based on our recognition of mid- to long-term rising air traffic demand led by growth in emerging economy countries, Marubeni entered the aircraft leasing business in 2010 and the engine leasing business in 2011. In 2013, Marubeni took a stake in Aircastle Ltd., one of the world’s major aircraft leasing companies, and in 2020, Marubeni completed full acquisition of the company by acquiring all of its shares together with Mizuho Leasing.

-

Aircraft Leasing Business -

Aircraft Engine Leasing Business (Singapore)

Commercial Vehicles Fleet Management Business

Marubeni provides fleet management services in the United States and Canada to meet the various commercial vehicle usage needs of customers. In addition, it develops refrigerated trailer leasing and railcar leasing businesses that respond to the strong demand for land transport in the United States. In 2024, Marubeni invested in Wheels, the largest fleet management company in the United States owned by a fund operated by Apollo (a U.S. asset management company), together with Lithia, the largest automobile dealer group in North America. While sharing business strategies related to Wheels with our partners, Apollo and Lithia, and proactively engaging in sustainable growth, we will work on collaborations with Apollo in the asset finance business and other businesses.

-

Fleet management business (U.S.) -

Railcar leasing, brokerage and third-party asset management (U.S.) -

Commercial vehicle rental & lease, sales and dealership business (Canada)

General Leasing and Non-bank Business

We provide the best solutions to meet our clients’ financial needs with our extensive product lineup. In 2020, Marubeni invested in Auxilior Capital Partners, Inc., a company in the U.S. vendor finance market, through Mizuho Marubeni Leasing Corporation. In 2024, Mizuho Leasing Company, Limited a major Japanese leasing company, entered into an agreement with Marubeni to become a member of the Marubeni Group. Going forward, Mizuho Leasing and Mizuho Marubeni Leasing will further expand Marubeni’s leasing and financing operations in both domestic and international markets, focusing on captive finance services for the Marubeni Group and beyond.

-

Asset Financing for Ships and other such Assets -

Vendor finance business (U.S.) -

Investment in Onshore Wind Farm Project (U.K.)

Next Generation Finance Business and Femtech Business

We are aiming to develop a new finance business model through strategic investments in fintech-related companies.

In anticipation of growing global demand for consumer digital financial services, we invested in AND Global in 2020, a company with its headquarters and fintech development facility in Mongolia. We also invested in ETOMO FINANCING CORPORATION, which is developing a mobile lending business (a financial service provider using mobile apps) in the Philippines, in 2023. Through these strategic investments in fintech-related enterprises, we are working toward developing innovative financial business models.

In the femtech business, we are supporting solutions that contribute to improving the health and work environments of working women through LIFEM Inc., which was established in 2022. Through the provision of our services, we will support diversity, equity, and inclusion (DE & I) and wellness management, and promote the strengthening of corporate competitiveness.

-

Providing fintech solutions -

Financial service provider using mobile apps -

Development and operation of femtech services for businesses

Insurance business

In the insurance business, we have a global network with a multitude of non-life and life insurance companies worldwide. We also provide risk management services in line with corporate and individual clients’ needs, including insurance and reinsurance arrangements and insurance claim in the event of an accident, mainly through Marubeni Safenet and Wizleap, two insurance agencies in Japan, and the Marnix Group (Tokyo, Singapore, London), an insurance broker overseas.

-

Marubeni Business Partner Association, which provides inexpensive group insurance -

Lloyd’s of London (interior of the building) -

Wizleap’s “Money Career,” a financial consulting service

Private Equity and Fund Management Business and Domestic Investment

The Marubeni Group plans and manages private equity funds targeting small and medium-sized companies in Japan and overseas. We provide solutions to all stakeholders, including investors, portfolio companies, and society, by leveraging our investment know-how accumulated over 30 years as well as the business support we provide with portfolio companies through our capabilities as a general trading company, bringing together strengths from across the Marubeni Group. We are managing funds totaling over JPY 100 billion, including those managed by iSigma Capital Corporation, one of our core subsidiaries, and a joint venture with Advantage Partners Group, one of the largest PE firms in Japan, aiming to support companies’ sustainable growth through solving management issues and addressing social issues.

In the domestic investment, we will incorporate new business platforms and business models through M&A. At the same time, we will utilize the knowledge we have acquired in the PE business to grow our portfolio companies by improving management efficiency, productivity, and overseas expansion, based on the fundamental policy of long-term ownership.

-

Private equity fund management business (Japan) -

Advantage Partners Asia Fund, L.P. located in the center of Singapore (image)

Domestic and Overseas Real Estate Development & AM Businesses

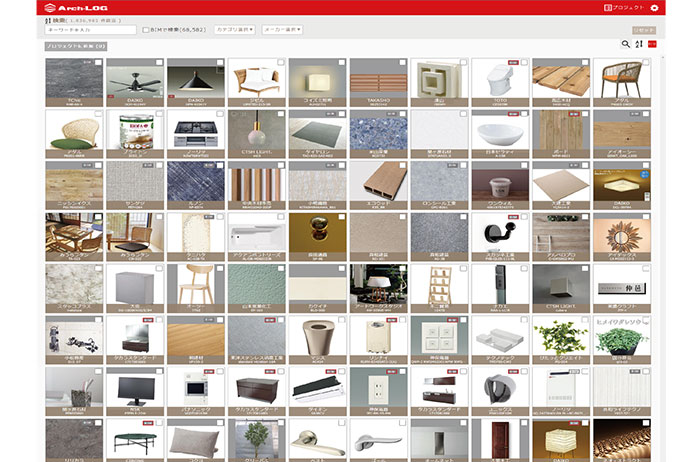

Over 50 years, Marubeni has accrued a track record of over 80,000 units in the domestic condominium development and sales business. Our domestic real estate business covers a wide range of areas, and we continue to develop our capabilities in various facets of the industry, including real estate development and planning proposals for various assets, facility operation and management, and real estate brokerage. We are striving to provide attractive real estate and financial products. In recent years, we have been working on new businesses in real estate and construction sectors, including a building material search platform, which enables workers in construction industry to work more efficiently, and we will further expand our business.

Outside of Japan, we are utilizing the know-how we accumulated in the domestic real estate development business to develop a real estate development business centering on condominiums in China, ASEAN countries, and India, where the middle-income demographic is expanding and demand for housing is high. In the U.S., we also provide one-stop asset management services related to U.S. real estate investment for Japanese investors in addition to investments in rental housing currently in operation in the country. The services include providing acquisition advice on real estate investment properties, post-investment general asset management, and proposals and executions of sales for properties.

-

The Tower Yokohama Kitanaka (Kanagawa Prefecture) -

Arch-LOG (A building material search platform for real estate-related businesses, Japan) -

Estates at Team Ranch(賃貸住宅投資)(米国・ダラスフォートワース)

Real Estate REIT and Fund Management Business

The Marubeni Group manages a total of more than 1 trillion yen in real estate, including the private placement fund business (AUM of JPY 188.4 billion as of the end of January 2025), which is optimized for individual investors. The Group started with private REIT United Urban Investment Corporation (AUM of JPY 704.9 billion as of the end of January 2025) in 2003, followed by Marubeni Private REIT Investment Corporation (AUM of JPY 379.8 billion as of the end of January 2025), another private REIT, in 2014.

In addition, Marubeni launched Japan Infrastructure Fund Investment Corporation (AUM of JPY 71.1 billion as of the end of January 2025) in 2019, entering the management of funds for renewable energy facilities.

Regarding Marubeni Real Estate Management, which plays a central role in the real estate one-stop solution business, the Marubeni Group is expanding its active involvement in services related to real estate management and operation and further expanding its asset scale and its business through management and operation.

-

KIC Sayamahidaka Distribution Center (Saitama Prefecture) -

Prime Square Shinsaibashi (Osaka) -

Fukushima Ishikawa Solar Power Plant (Fukushima Prefecture)